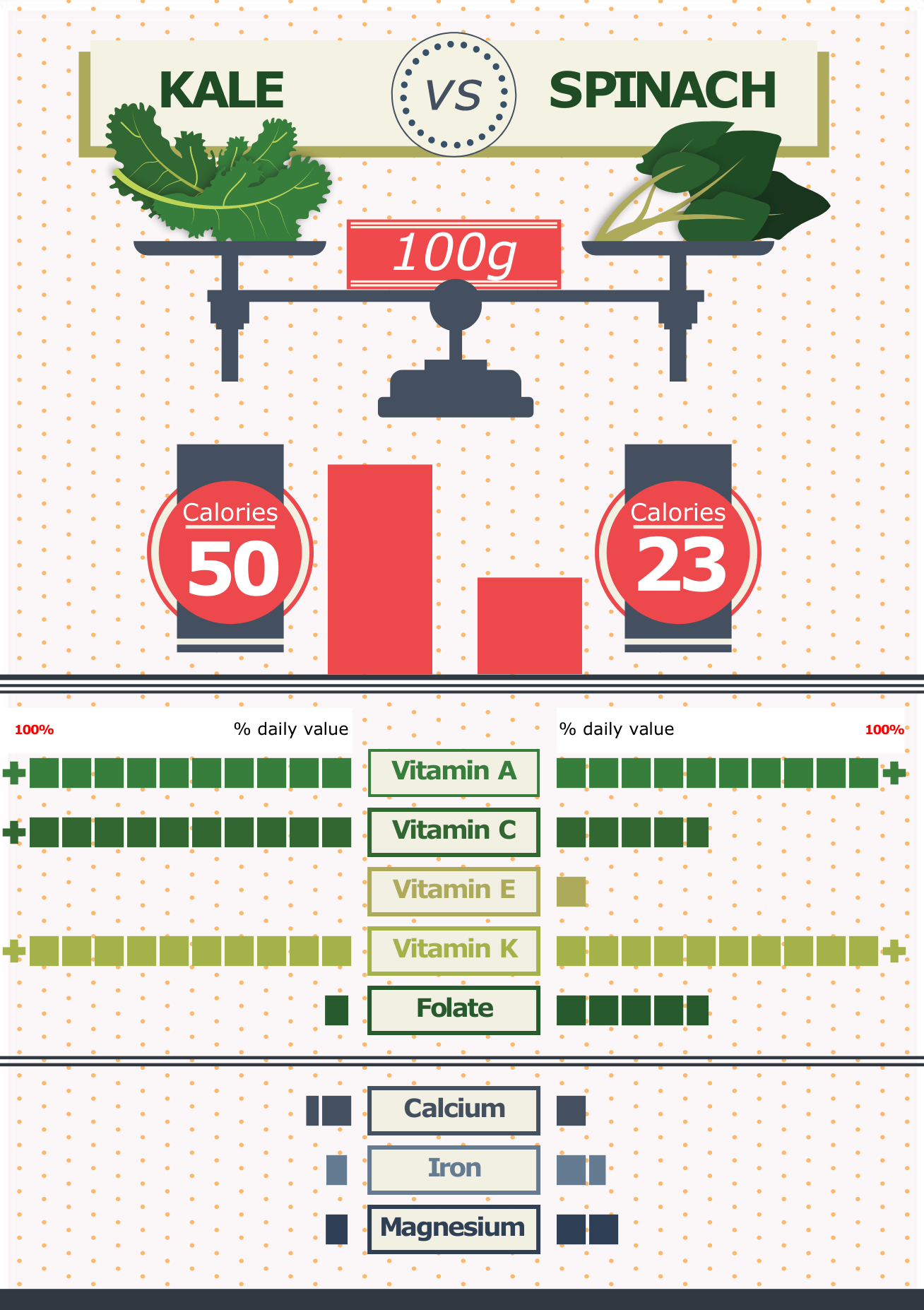

Interestingly, there was a narrower margin in choosing between the importance of time (61%) over money (39%).īeyond monetary figures, these findings illustrate the layers that influence what it means to feel financially healthy today, and how this affects an individual’s overall quality of life. Meanwhile, enjoying experiences (70%) was a better reflection of wealth compared to owning many nice things (30%). In fact, the survey indicates that many Americans place greater importance on non-monetary assets over monetary assets when they think of wealth.įor instance, 72% said having a fulfilling personal life was a better descriptor of wealth than working on a career, which was only chosen by 28% of respondents. When digging deeper, it becomes clear that wealth is not simply a number. Millennials were most likely to feel wealthy, at 57% of respondents, while 40% of boomers felt wealthy, the lowest across generations surveyed. Here’s the breakdown for major cities, illustrating the paradox: This is a considerable divergence from the $2.2 million benchmark they said was needed to be wealthy. Overall, 48% of all respondents said they feel wealthy, and those people had an average net worth of $560,000. Separately, the survey asked whether respondents “feel wealthy” themselves. The average salary is $67,000 in Houston, while in San Francisco it falls at $81,000. Step 3: Replace the content of the template with your own. Step 2: Pick a comparison infographic template or product comparison template that fits the story you want to tell.

Comparison chart infographic free#

Houston, where the cost of living is less than half of San Francisco, respondents said a net worth of $2.1 million is needed to be wealthy. Here’s how: Step 1: Create a free Venngage account and visit our comparison infographic templates page.

It is home to over 345,000 millionaires, the highest worldwide.

In New York, it takes $3.3 million in net worth to reach this target. In Los Angeles and San Diego, it takes $3.5 million to be wealthy, the second-highest across cities surveyed. The vast majority of people in San Francisco say that inflation has had an impact on their finances, and over half say that living in the city impedes their ability to reach their financial goals, citing steep costs of living. This figure dropped from last year, when it stood at $5.4 million. In San Francisco, respondents said they needed $4.7 million in net worth to be wealthy, the highest across all cities surveyed, and more than double the national average. Net Worth to Be "Financially Comfortable"

0 kommentar(er)

0 kommentar(er)