#Total operating expenses meaning how to#

Built to help you elevate your game at work, our courses distill complex business topics - like how to read financial statements, how to manage people, or even how to value a business- into digestible lessons. Pareto Labs offers engaging on demand courses in business fundamentals. That’s why it’s important to look at debt ratio as an additional metric when evaluating a company’s performance.

What operating ratio doesn’t reflect is debt. Analysts want to see operating ratio decrease over time, as that suggests that a company is becoming more efficient and retaining a higher percentage of every dollar of revenue. The result is a percentage, which represents the portion of revenue that is spent on core operation of the business. Operating ratio = (Operating expenses + Cost of goods sold) / Revenue It’s calculated using the following formula: Operating ratio is a financial ratio that measures operational efficiency of a company. Examples include interest on financing, or other borrowing costs. Non-operating expenses are costs not associated with the core business operations. They appear on a company’s balance sheet, rather than on the income statement.They are not fully tax-deductible in the year they are purchased rather, they are deductible over time.

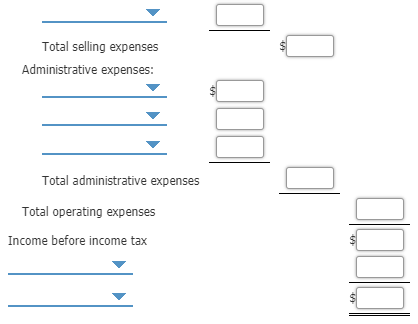

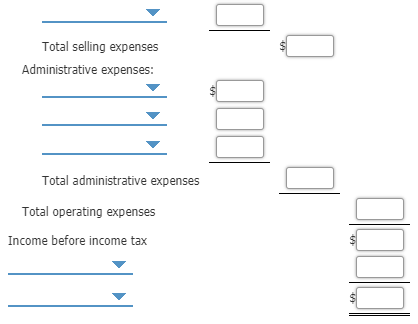

Property purchases or upgrades and expansions to existing propertyĬapital expenditures have several key differences from operating expenses:. Other examples of capital expenses include: So while rent on an office space is considered an operating expense, if a business were to purchase a new production plant to manufacture goods, that would be considered a capital expenditure. Whereas operating expenses are business expenses incurred by day-to-day operations of a business, capital expenditures are costs associated with major purchases-that is, purchases of assets a business will use for more than a year. These costs are generally fixed, meaning they don’t vary directly with sales volume. They also bucket Selling, General, and Administrative Expenses (often abbreviated SG&A) together. Note: Because Apple spends a lot on R&D, they choose to itemize and break out that line separately here. They are sometimes represented as a single line item, or they may be broken out into multiple line items for different types of expenses. Operating expenses appear below the line on a company’s income statement. Operating expenses on an income statement OPEX are tax-deductible in the United States (for businesses that earn a profit). You can calculate operating profit (also referred to as operating income) by deducting operating expenses from gross margin. Operating expenses are paid for with gross margin dollars. This includes advertising costs like media buying, sales commissions, as well as entertainment and travel expenses when sales reps visit clients. Sales and marketing: These are exactly what they sound like-costs associated with promoting the business and its products. Office expenses: This includes costs associated with running an office, such as rent and office supplies. Salaries of employees working on new products are included in Research and Development expenses. Research and development (R&D): This includes all cost and spending for things like designing and improving existing products, or inventing new products. It also includes benefits like employer contributions to employee 401k plans. This includes salaries for executives and departments such as Human Resources (HR). Compensation: Payroll expenses for employees not directly related to production of goods or providing services to customers. Operating expenses include (but aren’t limited to): Operating expenses are abbreviated “OPEX” and sometimes referred to simply as “overhead.” Operating expenses are the costs associated with running a business that are not direct ingredients or raw materials needed to make the products or services sold. OPEX does not include the cost of goods sold (COGS) or capital expenditures. Operating expenses include rent and other fixed costs, as well as variable costs for office supplies, or operating activities such as research and development expenses. Operating expenses (also called OPEX or overhead) are the amount of money a company spends on business operations.

0 kommentar(er)

0 kommentar(er)